Richemont’s Luxury Brands Continue to See Growth Except in China

This week Richemont released a review of their third quarter, and the numbers indicate continued growth in the haute horlogerie industry. The luxury conglomerate’s numbers for the three-month period which ended December 31, 2013 show growth in all regions and strong retail performance.

Although the strengthening of the euro against the dollar and yen had a negative impact on the group’s reported sales, Richemont’s net cash position at December 31, 2013 amounted to €4.3 billion (approximately US$5,840,690,000) a strong growth over 2012’s €3.0 billion (approximately US$4,074,900,000).

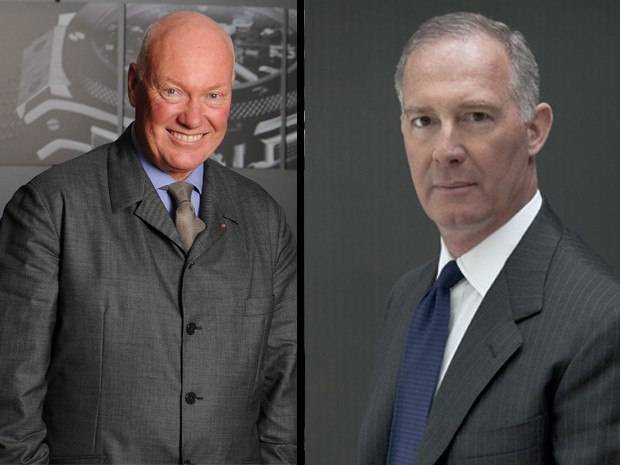

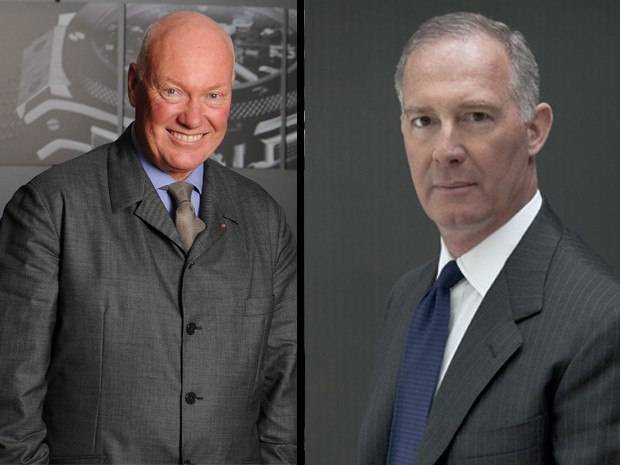

During this period, Richemont’s jewelry and watch manufactures, which include Vacheron Constantin, Baume & Mercier, Jaeger-LeCoultre, Lange & Söhne, Cartier, Officine Panerai, IWC, Piaget, Van Cleef & Arpels, Montblanc and Roger Dubuis, performed well.

While caution amongst the group’s business partners (particularly in the Asia Pacific region) led to slower growth in the wholesale channel, Richemont’s retail has performed well. The Jewelry Maisons reported solid sales growth in their own boutique networks. Meanwhile, the watchmakers enjoyed continued growth during the period, albeit at a lower rate than the first six months of the year.

According to Richemont, all major markets reported growth, except for mainland China, which reported lower sales. The performance in Europe and the Middle East was satisfactory. Sales continued to benefit from visitors to the region’s major tourist destinations. In Asia Pacific, growth remained relatively consistent with the trend seen in the first six months of the current financial year, taking into account the less challenging figures during the comparable three-month period. Sales growth in the Americas region was good, led by robust retail demand, particularly in jewelry. Domestic purchases in Japan remained strong, although the rate of sales growth slowed down compared to the first six months of the current financial year.

Figures courtesy Richemont.

SIGN UP

SIGN UP